MEMORANDUM

To: Clients and Friends of Ariel Investments

From: Mellody Hobson, Co-CEO and President

Date: October 3, 2023

Re: International and Global Separate Account Update

I recently sat down with Henry Mallari-D’Auria in his expanded role overseeing our Ariel International and Global strategies to get an update on the portfolios. I thought I would share the conversation.

MH: You are one month in. What is your plan?

HMD: We have set out in the management of the portfolios with four clear goals:

1) Bring down our cash levels to be more fully invested.

2) Reduce the “tail” comprised of holdings representing less than 1% of the portfolios so each of our resulting holdings might have more impact.

3) Lessen the portfolio concentration in the top three names to better manage risk.

4) Focus the research analysts on the sweet spot of good valuation and good business momentum to drive more upside participation.

MH: How much cash has been redeployed since you started, and how many stocks have been eliminated from the tail?

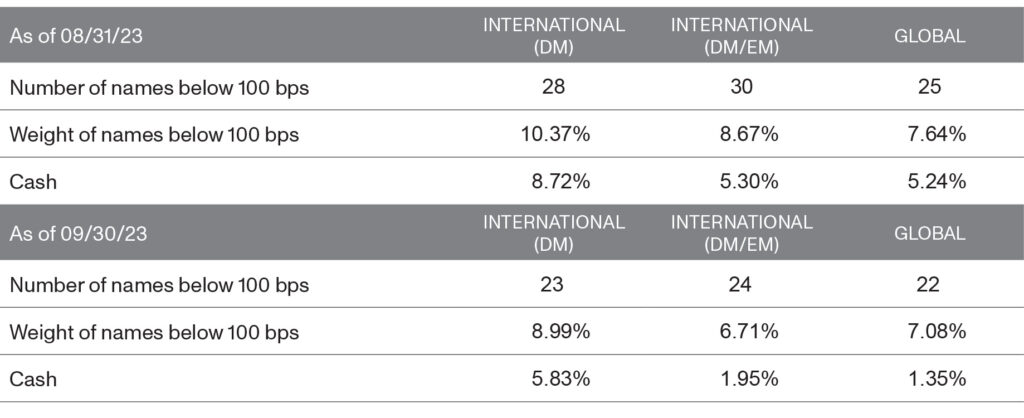

HMD: In the first month, we have made progress on each of our stated goals. This is not an overnight effort, and we will continue to be very deliberate about any and all portfolio changes. In addition to being very thoughtful about stock selection, we are cognizant of the fact that a transition is a fluid process. There are two sides of the equation—portfolio management and cash management. As we eliminate the tail, our desire is to redeploy the cash generated to move further towards being fully invested. The picture on the next page tells the story of our actions in our separate accounts.

MH: How many stocks do you ultimately expect to hold, and how much cash?

HMD: We are targeting about sixty stocks. Initially, as we jettison the smallest positions, we may dip below our target size before we get to our ideal portfolio. It is also possible that some of those small names might grow into full positions. The goal is to own the right companies in enough size to impact our results. In normal market conditions, cash should not exceed 2% of any portfolio.

MH: How long will it take to get to your ideal portfolios?

HMD: Another 10 weeks or so.

MH: How else have you changed the portfolios?

HMD: In an effort to be rigorous and disciplined, we have done the following:

1) Trimmed one of our largest holdings.

2) Added to three stocks that we already own.

3) Bought two new names.

Any company we buy will come with a controversy that we think has caused mispricing. While we like our defensiveness and will seek to maintain it, we also want to include lower P/E and lower price-to-book issues that offer some upside participation as consensus begins to see a path to resolution.

MH: How are you working with the team?

HMD: They are all highly energized by having a greater level of participation as Micky and I consider which companies end up in the portfolios. We have been more explicit about the rules—how a name gets into a portfolio. The idea of focusing on attractive valuation and business momentum has gone over well.

All of our estimates are current—including estimates for stocks that aren’t attractive. Going forward, we will not be as obsessive about updating models on names we will not own. This directive has invigorated the group because the analysts want to spend their time on the work that will move the portfolio. In short, our efforts are no less thorough but are more focused. To this last point, we will soon introduce a quantitative tool to help analysts prioritize, which will further augment productivity.

The international/global and emerging markets team members are now co-located. It’s clear that there are healthy and vibrant conversations between the groups, even though the decision-making is happening separately. Healthy conversations and some joint projects.

MH: And your weekly research meetings?

HMD: At our last research meeting with just the I/G team, we discussed our recent trades and the drivers of our relative performance. Our team validation process still exists, but it has been expanded to include the whole group. We also now conduct a round-robin where analysts discuss anything relevant to our portfolios that they believe their teammates should know. I am most excited about the collaboration of expert minds. We filled an hour with lots of great discussion and interaction—which I love. They’re all getting to be more comfortable.

MH: You hold a joint meeting with both the I/G and EM teams that includes senior members of the domestic team. How has that been going?

HMD: That’s definitely helpful for two reasons:

1) I think the domestic team has found some of the topics interesting, including one we had on the broader implications of weight loss drugs.

2) The I/G analysts hadn’t had much exposure to John, who is a great investor and contrarian thinker. His participation has added value and sent a very powerful message. The team sees the involvement of the firm’s CIO and Founder as proof that they are important and this effort is material to the company. They also have a chance to make an impression. It is an exciting time!

Investments in non-U.S. securities may underperform and may be more volatile than comparable U.S. stocks because of the risks involving non-U.S. economies, markets, political systems, regulatory standards, currencies and taxes. The use of currency derivatives and ETFs may increase investment losses and expenses and create more volatility. Investments in emerging markets present additional risks, such as difficulties in selling on a timely basis and at an acceptable price. The intrinsic value of the stocks within the strategy may never be recognized by the broader market. The strategy is often concentrated in fewer sectors than its benchmarks, and its performance may suffer if these sectors underperform the overall stock market. Past performance does not guarantee future results. The information provided in this commentary does not provide information reasonably sufficient upon which to base an investment decision and should not be considered a recommendation to purchase or sell any particular security. Views and opinions are as of the date of this commentary and can change without notice. There is no guarantee that any of the views expressed will come to fruition or any investment will perform as described. Portfolio holdings are subject to change.