MEMORANDUM

TO: Clients and Friends

FROM: Henry Mallari-D’Auria, CFA®, Chief Investment Officer, Global and Emerging Markets Equities

DATE: December 11, 2023

RE: International and Global Equities Update

I assumed responsibilities for the day-to-day management of the Ariel International and Global portfolios on September 1st and have been pleased to have my long-tenured Ariel colleague, Micky Jagirdar, work with me in executing our actively patient approach along with the pre-existing International and Global team.

When the portfolios first transitioned, we laid out four goals that we would seek to achieve by year end:

- Bring down our cash levels to be more fully invested.

- Reduce the “tail” comprised of holdings representing less than 1% of the portfolios so each of our resulting holdings might have more impact.

- Lessen the portfolio concentration in the top three names to better manage risk.

- Focus the research analysts on the sweet spot of good valuation and good business momentum to drive more upside participation.

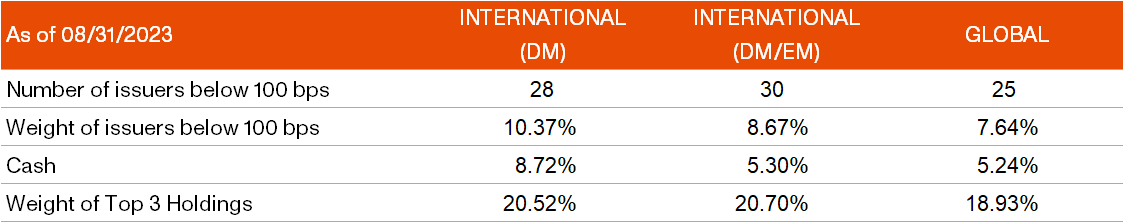

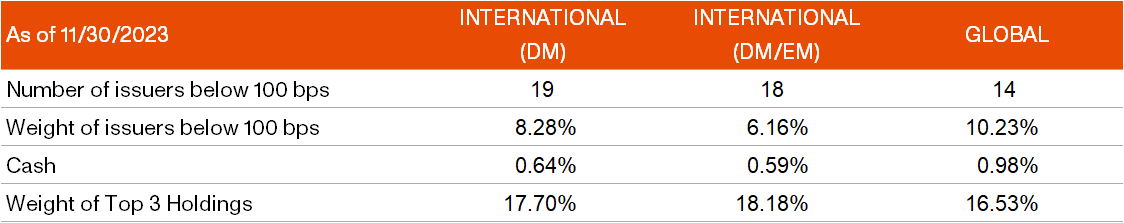

The charts below provide a quick snapshot of our collective progress.

CHANGES IN PORTFOLIO POSITIONING

- Our reduction in the number of “tail” positions below 100 basis points is a function of their elimination from the portfolio or an increased weighting so that they might to be more substantial contributors to our returns. We continue to evaluate the remaining names on a case-by-case basis and expect to have only a handful of decisions to make after year end.

- While we have added new securities, overall name count has declined as we have reduced the tail positions. That said, we expect the number of holdings to rebound by 5 or so names over time.

- The portfolios are now fully invested and cash should generally stay below 2%.

- To manage risk, our largest positions will now generally be capped at 5% above the benchmark at time of purchase.

- To further focus our research efforts, we have adopted a quantitative tool called the Ariel Investment Model or AIM, which allows us to consider valuation, quality and investor sentiment of a company while helping us to also assess when a controversy is closer to resolution.

Through the aforementioned efforts, we are seeking to insulate our portfolios in down markets through stock selection and diversification, while simultaneously delivering more up market participation through position sizing that can impact, but not excessively harm the portfolio.

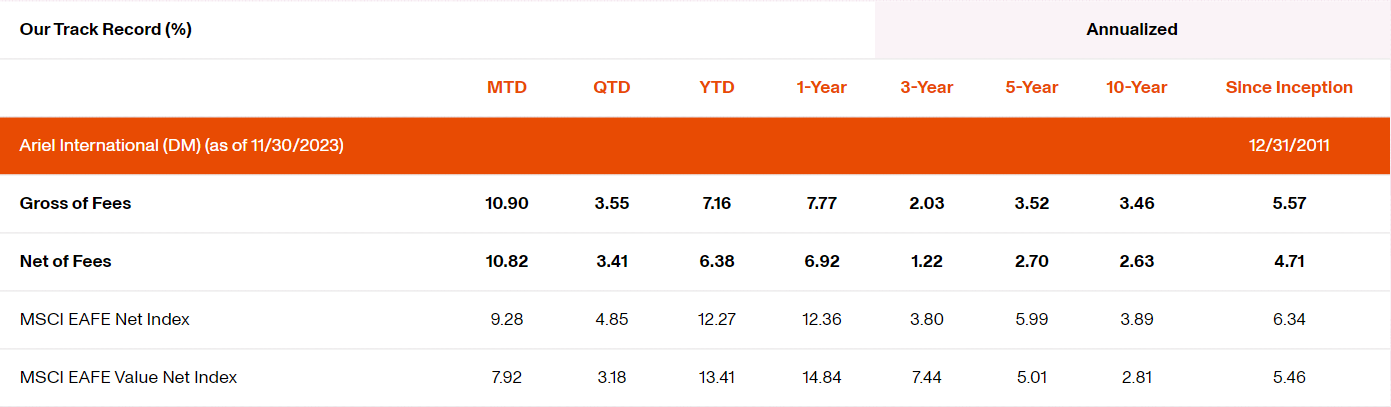

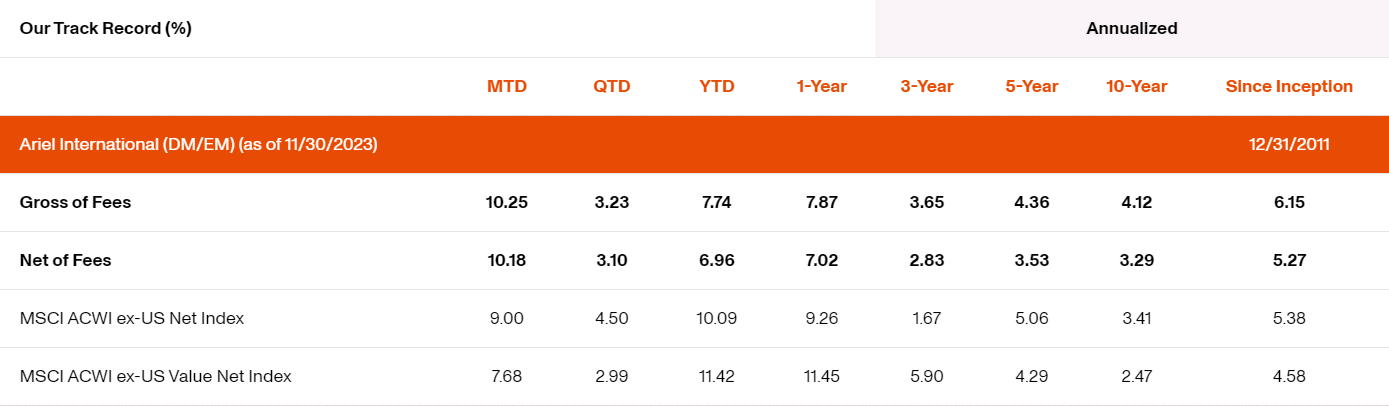

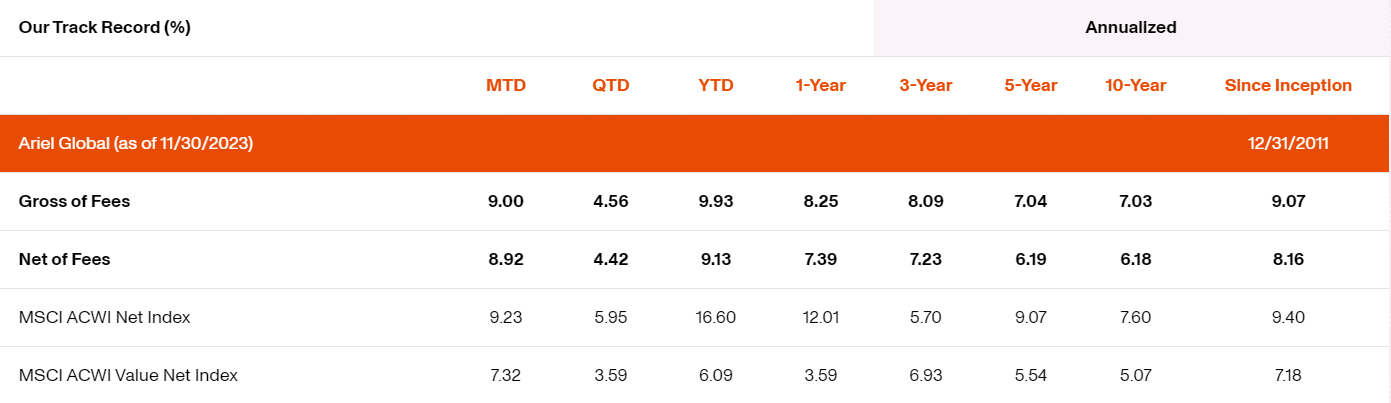

As we move into the New Year, we expect turnover to normalize at an annual rate of roughly 30%. Our early results are shown below with the November returns reflecting a portfolio that is closing in on our desired long-term positioning. We are 95% of the way there.

Please know we sincerely appreciate your continued consideration and look forward to keeping you abreast of our progress.

PERFORMANCE

Investing in small- and mid-cap stocks is more risky and more volatile than investing in large-cap stocks. Investing in equity stocks is risky and subject to the volatility of the markets. Investments in foreign securities may underperform and may be more volatile because of the risks involving foreign economies and markets, foreign political systems, foreign regulatory standards, foreign currencies and taxes. The use of currency derivatives, ETFs, and other hedges may increase investment losses and expenses and create more volatility. Investments in emerging markets present additional risks, such as difficulties in selling on a timely basis and at an acceptable price. A focused or concentrated portfolio may be subject to greater volatility than a more diversified portfolio. Certain portfolios are often concentrated in fewer sectors than their benchmarks, and their performance may suffer if these sectors underperform the overall stock market. The intrinsic value of the stocks in which the portfolio invests may never be recognized by the broader market.

Performance results are net of transaction costs and reflect the reinvestment of dividends and other earnings. Net returns reflect the deduction of the maximum advisory fee in effect for the respective period. Actual fees may vary depending on, among other things, the applicable fee schedule and portfolio size. Fee information is available upon request and may also be found in Ariel’s Form ADV, Part 2. Results shown may be preliminary. Returns are calculated in U.S. dollars. Index returns reflect the reinvestment of income and other earnings. Indexes are unmanaged, and investors cannot invest directly in an index.